If you’re ready to sell quickly for cash—without repairs, showings, or appraisal drama—this long‑form guide breaks down how a cash sale works in Bethesda, what it costs versus a traditional listing, how long it takes, and how to decide whether a direct, as‑is offer is the smartest move. Throughout this page, you’ll also see fully integrated links to authoritative resources so you can verify the facts and model your own net.

1) We Buy Houses in Bethesda, MD: How a Cash Sale Actually Works (Start to Finish)

We buy houses in Bethesda, MD with a process designed for speed, certainty, and simplicity. Instead of prepping for photos, scheduling open houses, and waiting for a bank’s appraisal, you share your address and situation, we tour once (often the same or next business day), and then we provide a transparent, as‑is cash offer. If you accept, we open title, confirm payoffs, and schedule a settlement date that works for you—often 7–14 days, or longer if you prefer. Because there’s no lender, there’s no underwriting queue, no appraisal contingency, and fewer failure points.

A Bethesda cash sale focuses on condition, time, and certainty. We routinely purchase homes with deferred maintenance, dated kitchens and baths, older roofs and systems, smoke or water damage, or tenant complications. You don’t need to make repairs to attract a retail buyer, coordinate contractors, or declutter everything—take what you love and leave the rest. That single decision eliminates weeks (or months) of preparation and reduces your out‑of‑pocket cash risk to near zero.

Here’s the step‑by‑step: (1) Tell us about the home and your timeline, (2) schedule a quick walk‑through, (3) receive a no‑obligation written cash offer with a simple net sheet, (4) choose your ideal closing date, (5) sign standard Maryland sale documents, (6) title clears liens/HOA or condo requirements, and (7) funds are wired to you at settlement. There are no commissions in a direct sale to us, and we customarily pay standard seller‑side closing costs (ask us for a written breakdown so you can see the net clearly). The end result: fewer moving parts, fewer delays, and a predictable outcome so you can plan your next move.

Contextual internal link to reinforce intent: If you landed here searching “sell my house fast Bethesda MD,” you can jump to the main page now: sell my house fast Bethesda MD.

2) Sell My House Fast Bethesda MD: Why Speed and Certainty Often Beat “Top Price”

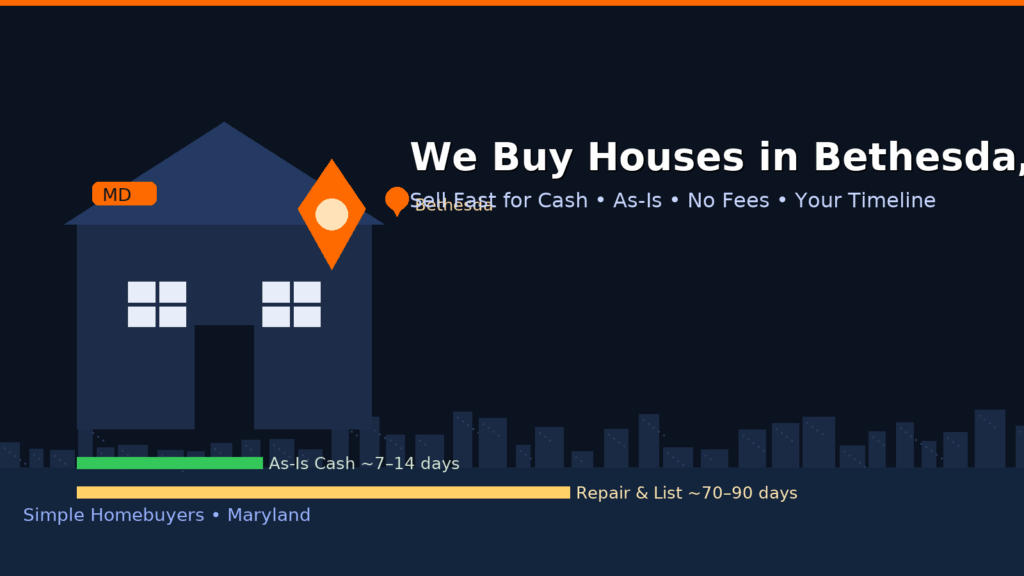

Sell my house fast Bethesda MD isn’t just a catchphrase; it’s a strategy that recognizes the time value of money. Listings with financed buyers can produce a higher headline price, but they also introduce months of work and uncertainty: pre‑listing repairs, staging, frequent showings, inspection negotiations, appraisal risk, and lender conditions. Every week you keep the property costs money—mortgage interest, taxes, insurance, utilities, yard care, and HOA/condo dues. If a buyer walks at the appraisal or loan‑condition stage, the clock resets. When you price your time honestly, a faster, certain path often delivers the stronger net‑after‑time outcome.

A Bethesda cash sale compresses the calendar to title and logistics. There’s no appraisal to miss, no slow underwriting, and no “punch list” to satisfy a first‑time buyer. If your priority is to be done—estate resolution, job relocation, divorce, or simply simplifying—guaranteed timing often matters more than chasing an extra percentage point that can evaporate through inspection credits or price reductions. Because we buy as‑is, you also avoid renovation cost over‑runs, permit queues, and the hassle of coordinating trades in a market where contractors run busy schedules.

Use a simple decision framework: What’s my net if I fix and list (after commission, transfer/recordation taxes, repairs, time, and re‑trade risk)? What’s my net if I sell as‑is for cash in about two weeks? Put real numbers in both columns—carrying costs on a high‑value Bethesda home can run $4,000–$6,000+ per month. When you add 1–3 months of hold time, the “higher price” path can yield a lower bottom line than a slightly lower cash number that closes on your schedule.

3) Bethesda Housing Market: Days on Market, Price Trends, and What They Mean for You

Bethesda average days on market matters because time = money. As of August 2025, the Redfin market dashboard shows homes in Bethesda selling after an average of 46 days on market, with a median price around $1.35–$1.4M, and 64 homes sold in the month (down from 69 year over year). That’s a strong, high‑price market—but it’s not instantaneous, and DOM has lengthened compared with last year. If you’d rather not carry a six‑ or seven‑figure asset for 1–2 months (or more), a cash sale eliminates most of that wait. See current data here: Bethesda housing market trends.

Why DOM shifts matter: longer time on market can increase price reductions, inspection requests, and seller concessions, particularly for homes that need updates. In a premium area like Bethesda, retail buyers often want turnkey. If your home needs work (HVAC, roof, windows, electrical), you’ll either invest to meet retail expectations or accept credits/repairs later. Both paths cost time. If holding costs on a $1M+ home are $4,000–$6,000/month, an extra 30–60 days can quietly eat $4K–$12K of your net. In contrast, a cash offer priced for condition and time can produce a higher net‑per‑day even if the headline price is lower.

Submarket differences matter, too. Neighboring North Bethesda recently posted 49 days on market and a markedly different median price profile, highlighting how micro‑markets diverge. If you want to see how your home stacks up, skim the local stats: North Bethesda housing market trends and zip‑specific pages like 20814 housing trends.

4) Traditional Listing Costs in Maryland vs. a Cash Sale in Bethesda (Real Numbers)

We buy houses in Bethesda with no commissions, and that single difference reshapes your net sheet. In a traditional sale, sellers typically pay broker commissions (often ~5–6% combined), state transfer tax, county recordation/transfer taxes, title/settlement fees, and frequently buyer credits after inspections. Maryland’s state transfer tax is generally 0.5% of the price, reduced to 0.25% for eligible first‑time Maryland homebuyers purchasing a principal residence. See state clerk guidance: Maryland state transfer tax basics (note: the same rule appears across county clerk pages).

For Montgomery County, recordation tax includes premium tiers that increased under Bill 17‑23 (effective October 1, 2023). The County’s finance page lists the new brackets and examples: Montgomery County recordation tax premiums (Bill 17‑23). If your Bethesda home sells near or above seven figures, those tiers matter; they can add thousands to the closing math. For modeling holding costs while you decide, consult the County’s rate hub and the current year schedule: County tax rate schedules (Levy Year 2025) and the official PDF 2025 real property tax rate schedule.

A simple example at $1,350,000: commission at 5.5% ≈ $74,250; state transfer tax 0.5% ≈ $6,750; County recordation/transfer varies by bracket but is not trivial at this level; add title/settlement and typical credits (another $2–5K+). It’s easy to land near $90–100K+ in sale frictions before mortgage payoff—exclusive of time. In a direct sale, there’s no commission, and we customarily cover standard seller‑side closing costs (request a written net so you can compare apples‑to‑apples).

5) Sell a House As‑Is in Bethesda: Repairs, Permits, and Code (What You Can Skip—and What You Can’t)

Sell house as‑is in Bethesda means you can skip making repairs to attract a financed retail buyer—but it doesn’t mean you can ignore safety or county requirements. In Montgomery County, when you reconstruct or replace damaged parts of a building, you generally need a Restore/Repair permit and inspections. Read the County guidance: Restore/Repair permit process. Those timelines and permitting costs are one reason cash sales feel simpler—you skip the project and we take it from there after closing.

“As‑is” still requires transparency under Maryland law. Sellers must provide either a disclosure (noting known defects) or a disclaimer (no representations) and must disclose known latent defects that affect health/safety either way. That’s codified in Maryland Real Property §10‑702 seller disclosure law. Deliver the Disclosure/Disclaimer Statement with your contract so you don’t create rescission windows. Doing this early also helps a serious cash buyer price with confidence instead of padding for “mystery.”

For older homes, if you (or anyone) will disturb paint during repairs, make sure the plan respects the EPA Lead Renovation, Repair and Painting (RRP) program. Choosing an as‑is cash sale pushes that compliance burden to us after settlement—another way to simplify your exit.

6) How Our Bethesda Cash Offer Is Calculated (Transparent Formula You Can Follow)

Cash home buyers in Bethesda (us included) use a math‑first approach you can replicate:

- ARV (After‑Repair Value): What your home would sell for after reasonable renovations, based on nearby sold comparables.

- Repair budget: Labor + materials to meet buyer expectations in your micro‑market (kitchen/bath modernization, systems, roof, paint/flooring, exterior, yard).

- Holding & resale costs: Taxes, insurance, utilities during construction + resale; closing costs and market risk when we list later.

- Margin & risk: Our profit for taking on the work and underwriting the project in an expensive area where carrying costs accumulate quickly.

Simple formula: Offer = ARV − Repairs − Holding/Resale Costs − Margin.

Why this helps you: it anchors our number in comps and construction reality, not guesswork. If you receive multiple offers, compare the math and terms, not just headline numbers. A higher “retail” offer saddled with financing, appraisal, and repair credits can net less than a slightly lower all‑cash offer with no contingencies. We are happy to walk you through comps, line‑item repair assumptions, and timing so you can see where we can be flexible (closing date, post‑occupancy, personal property inclusions, etc.).

Want us to run this analysis for your address and show you both paths? Start here: sell my house fast Bethesda MD.

7) Situations We Specialize In: Inherited Homes, Relocation, Problem Tenants, Fire/Water Damage

We buy houses in Bethesda in a wide range of real‑life scenarios. If you’re handling an inherited property, you may be juggling probate paperwork, distant heirs, or a house full of belongings. We’ll coordinate a single walk‑through, let you take what you want, and arrange clean‑out after closing. For relocation, your priority is certainty—a locked settlement date and a guaranteed net so you can line up your next purchase or lease. We’ll match your timeline and can include post‑settlement occupancy if you need a few extra days.

Tenant situations and vacancy risk are also solvable with a direct sale. Retail buyers often balk at non‑cooperative tenants, month‑to‑month leases, or the perception of risk around vacant homes. Cash buyers underwrite that complexity on day one and price it appropriately. If your home has deferred maintenance (original systems, older roof, drafty windows) or visible damage (water intrusion, smoke, or structural concerns), we’ll assess the scope and incorporate it into the offer—no shaming, no “punch list” to complete before we’ll buy. For homes affected by fire or smoke, the USFA “After the Fire” safety guide is a helpful resource while you decide whether to repair or sell.

The goal is fit. If you prefer to chase a retail number and have the time and cash to renovate, that’s a valid choice. If you prioritize speed, privacy, and guaranteed timing, a fair cash offer that solves problems—not just buys a house—may be the better path. Either way, we can model your net both ways so you’re deciding with numbers, not guesses.

8) Closing in Montgomery County: Title, HOA/Condo Docs, Payoffs & Settlement (Fast but Thorough)

Sell my house fast Bethesda MD still includes the essential mechanics of a safe transfer—title research, HOA/condo diligence, and payoff coordination—but because there’s no lender, everything is simpler. Title searches the property for liens, mortgages, judgments, water/sewer or utility balances, HOA/condo dues, or County violations. You provide payoff information and HOA/condo contacts; title orders resale packets where applicable. If the property is in an estate, title verifies authority; if it’s held in a trust, the title company verifies trustee powers. Once payoffs are confirmed and documents are prepared, you pick a settlement date and choose wire or cashier’s check.

Taxes at closing are calculated using up‑to‑date state and county schedules. For the state, see Maryland state transfer tax basics (the same rule is repeated on multiple clerk pages). For County recordation premiums effective Oct. 1, 2023, see Montgomery County recordation tax premiums (Bill 17‑23). For a snapshot of current rate schedules (helpful for modeling carry), consult County tax rate schedules (Levy Year 2025) or the 2025 real property tax rate schedule (PDF). If you want a broader property‑tax explainer from the State’s perspective, SDAT’s page covers the moving parts: Homeowners guide to Maryland property tax.

Because there’s no appraisal or lender, we can work toward a two‑week closing when needed. If you’re out of state, we can often arrange a mobile notary or remote online notarization (depending on title company offerings). If you need a bit of extra time in the house after funding, we can write a short post‑settlement occupancy so your move is calmer.

9) What to Expect from Day 1 to Day 14: A Realistic Cash‑Sale Timeline

Cash home buyers in Bethesda can move quickly, but “quickly” still includes a few reasonable milestones. Day 1–2: you reach out, we capture basics (bed/bath, square footage, age, updates, known issues), and we schedule a walk‑through. Day 2–4: we tour once, verify the layout and condition, then send a written, as‑is cash offer with a clear net sheet and a target closing window. Day 4–6: if you accept, we open title immediately and you provide payoff information; we order HOA/condo resale docs (if applicable). Day 6–8: a brief access window for our contractor (or inspector) to confirm scope—no “nickel and diming,” just enough to confirm what we underwrote.

Day 8–12: title clears payoffs, addresses any liens/judgments, and prepares closing documents. If you’re traveling or out of state, we coordinate signings. You pack what you want; if we agreed to handle clean‑out after settlement, we’ll schedule it. Day 12–14: we sign, funds are disbursed (wires usually same day), keys transfer, and you’re done. If you prefer a different schedule, we simply pick a later settlement date—speed is optional, but available.

This system eliminates listing prep, buyer financing, appraisal delays, and prolonged inspection renegotiations. Because we model repairs, taxes, and resale risk up front, there’s nothing to “discover” later and no reason to re‑trade unless title uncovers something unusual. Even then, we work with the title company to clear it, keep your timeline intact, and close with your known net.

10) FAQ: We Buy Houses in Bethesda, MD (Disclosures, Fees, Price & Possession)

Do I need to make repairs first? No. We buy houses in Bethesda as‑is, and we expect to renovate after closing. No staging, no showings, no punch list.

What fees do I pay? In a direct sale to us, there are no commissions, and we customarily cover standard seller‑side closing costs. You’ll still see state and county taxes on the closing disclosure. For the state, see Maryland state transfer tax basics. For County recordation premiums, see Montgomery County recordation tax premiums (Bill 17‑23). For broader property‑tax context, SDAT explains how assessments and rates interact: Homeowners guide to Maryland property tax.

What do I have to disclose? Maryland requires sellers to deliver the Residential Property Disclosure/Disclaimer Statement and to disclose any known latent defects that affect health/safety—even in an as‑is sale. That’s the heart of Maryland Real Property §10‑702 seller disclosure law. Deliver the form with your contract to avoid rescission windows.

Should I consult my insurer before selling a damaged home? Yes. If you’re weighing repair‑and‑list versus as‑is, understand your policy’s cash‑flow (ACV now, RCV later). The Maryland Insurance Administration’s consumer PDFs are a solid primer: Homeowners insurance guide and homeowners shopping tips.

Is there any safety guidance if my home was recently affected by smoke/fire? Yes—review the USFA “After the Fire” safety guide for practical steps on utilities and cleanup.

11) Neighborhoods We Buy Houses In (Bethesda & Nearby Micro‑Markets)

We buy houses in Bethesda, MD across the entire area and next‑door neighborhoods: Downtown Bethesda (Woodmont Triangle, Battery Lane), Edgemoor, Greenwich Forest, Bradley Hills, Glen Echo Heights, Alta Vista, Wildwood, Westmoreland Hills, Westbard, Wyngate, Sumner, and bordering Chevy Chase and North Bethesda. These micro‑markets differ on price points, buyer expectations, commuter access, school clusters, lot characteristics (flat vs. slope), and the feasibility of value‑add improvements. That context matters when we estimate ARV and set the closing plan that fits your situation.

If your home needs work—aging roofs, galvanized plumbing, original windows, dated kitchens and baths—retail buyers at Bethesda price points often expect modern finishes. Instead of doing the renovation yourself, sell as‑is and let us handle it after closing. If you’d like to sense how your location compares to nearby markets, review local stats like North Bethesda housing market trends or zip‑focused pages such as 20814 housing trends. We tune our offers to your submarket, not just county averages, so your specific property gets a fair, data‑driven number.

12) Your Best Next Step: Request a No‑Obligation Cash Offer for Your Bethesda Home

Sell my house fast Bethesda MD and reclaim your time. If you’re staring at repair estimates, staging plans, and appraisal worries, consider the certainty trade: a no‑obligation cash offer that closes on your timeline and removes the heaviest frictions—repairs, showings, commissions, and lender risk. Your role is simple: give us the address, share what you know (we’ll guide you), and open the door once. We handle underwriting, title work, and coordination. You choose the closing date and how you’d like to be paid. That’s it.

Here’s what we promise: a respectful, pressure‑free process; a transparent offer grounded in Bethesda comps and real repair numbers; and clear answers about Maryland taxes, disclosures, and documents so you understand your exact net. If a different path would leave you better off (for example, a light refresh and retail listing in a turnkey micro‑market), we’ll say so. We build our business on fit, not hard sells.

Ready? Tell us about your property, pick a time for a quick walk‑through, and we’ll deliver a written as‑is cash offer you can accept, decline, or sleep on. If you need speed, we can target 7–14 days. If you need flexibility, we’ll structure occupancy or a later closing. Either way, you’ll have certainty—and that’s what most Bethesda sellers are truly after. When you’re ready to take the next step, start here: get a fast, as‑is cash offer in Bethesda.