If you’ve recently inherited a house in Temple Hills, MD, it might feel like both a blessing and a burden. On one hand, you’ve received valuable real estate. On the other, you’re now responsible for a property that may come with hidden issues like mold or water damage. For many heirs, especially those who live out of state or are juggling family matters, the process can quickly become overwhelming.

You might be asking: How much is mold remediation going to cost? Is it even worth fixing before I sell? What if I can’t afford to hold the property for months? These concerns are common—and valid. The reality is that inherited homes often sit vacant for months, creating the perfect breeding ground for moisture buildup and mold growth.

In this guide, we’ll walk you through how to handle inherited homes in Temple Hills with mold or water damage. We’ll explore your legal obligations, costs, buyer expectations, and why selling the property to a local cash buyer like Simple Homebuyers may be the fastest, safest, and most financially smart option.

What Causes Mold and Water Damage in Inherited Homes?

Mold and water damage often go hand in hand. Inherited homes are particularly susceptible because they are frequently unoccupied for extended periods. Without regular maintenance, even minor leaks can turn into mold disasters. Here are some common causes:

- Leaky roofs or old plumbing: Aging pipes and outdated roofing systems are prone to leaking, especially in homes built decades ago.

- Poor ventilation: An empty house with closed windows traps humidity, encouraging mold growth.

- Flooding or heavy rain: Temple Hills sees frequent seasonal storms, and without sump pumps or modern drainage systems, basements can flood easily.

- HVAC neglect: If the air conditioning system hasn’t been used or cleaned in months, it may develop mold in the ducts.

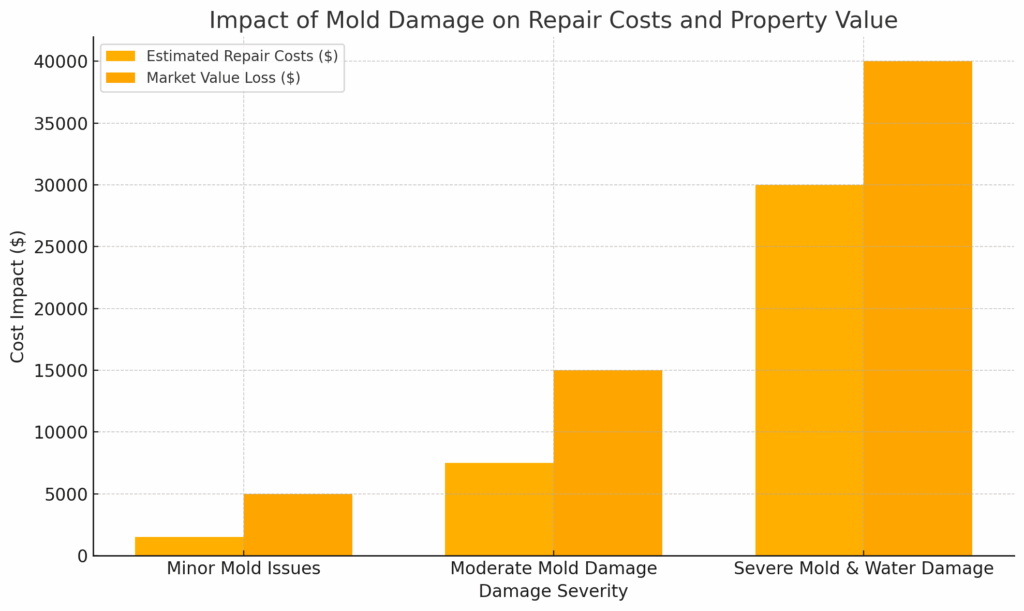

The longer a property sits unoccupied, the more time these issues have to fester. What could have been a $1,500 fix may now cost over $10,000 if the mold spreads behind walls or floors.

According to This Old House, black mold remediation can cost as much as $30,000 in extreme cases.

This is why acting quickly—and strategically—is key.

Legal Responsibilities When Selling an Inherited House With Mold in Maryland

Maryland law requires full disclosure of known material defects when selling real estate—including mold and water damage. As the executor or heir, you are legally obligated to be honest about:

- Known mold contamination (visible or tested)

- Past or current water damage

- Any insurance claims made for mold/flooding

- Professional remediation (or lack thereof)

Failure to disclose mold could result in lawsuits from buyers, even after closing. This is particularly risky when selling through a traditional agent where buyers expect a home to be “move-in ready.”

However, if you choose to sell the property as-is to an experienced investor, you may be able to legally bypass remediation as long as you disclose the issue. Many investors, including Simple Homebuyers, are well-versed in Maryland disclosure laws and accept mold issues without requiring repairs.

This route lets you sell quickly without risking litigation or violating state law.

Should You Clean Up the Mold Before Selling?

This is one of the most important decisions you’ll need to make.

Remediating mold before listing the property through a real estate agent is often necessary to attract traditional buyers. But here’s the problem: mold remediation is expensive, time-consuming, and not always effective on older homes.

In Temple Hills, mold remediation typically costs between $2,000 and $8,000, depending on the extent of the damage. Severe cases—especially those involving HVAC systems, drywall, or flooring—can push costs well beyond $15,000. And that’s just the beginning. These figures don’t account for additional expenses like staging, agent commissions, or the time your property may linger on the market. For a detailed breakdown of local mold removal pricing, check out HomeYou’s cost guide for Temple Hills.

If you’re dealing with a home that needs work in multiple areas—mold, water stains, outdated electrical, worn-out roofing—you may be better off selling as-is to an investor. Companies like Simple Homebuyers specialize in these situations. They evaluate the cost of repairs internally and make cash offers that remove your financial and legal burden.

Selling the home as-is could save you months of stress and thousands of dollars.

How Mold and Water Damage Affect the Property’s Market Value in Temple Hills

When you’re trying to sell an inherited house in Temple Hills, the presence of mold or water damage will significantly influence its market value—and often not in your favor. Traditional buyers tend to avoid properties with known damage due to the perceived risk and the uncertainty of hidden problems. Even if you’re upfront and transparent, buyers are likely to demand a steep discount or walk away altogether.

Appraisers and real estate agents typically assess mold or water-damaged homes at 15% to 50% below comparable market value depending on the extent of the issue. Here’s why:

- Reduced Buyer Pool: Most buyers financing through FHA, VA, or conventional loans can’t purchase homes with visible mold. Lenders may flag the property as uninhabitable, which immediately limits your pool of buyers to those who can pay cash.

- Lower Appraisal Value: Even if a buyer is willing to move forward, a low appraisal may derail the deal. Mold and water damage often trigger red flags during inspections, reducing the appraised value and killing the financing.

- Perceived Liability: Many buyers fear the potential health risks of mold or future insurance issues, especially if the property wasn’t properly remediated or disclosed.

According to Zillow, visible water damage or past mold problems can scare off buyers—even if the issue has been addressed—because of lingering stigma.

This puts sellers of inherited homes in Temple Hills in a difficult position. You can attempt to repair everything in hopes of reaching full market value (and gamble thousands of dollars in the process), or you can price the home competitively for a quick sale to a cash investor who expects damage and is ready to buy as-is.

When speed, convenience, and certainty matter—especially for out-of-town heirs or those navigating probate—selling to an investor may offer the highest net outcome with the least hassle.

Why Out-of-State Heirs in Temple Hills Often Choose to Sell Mold-Damaged Homes for Cash

If you’ve inherited a home in Temple Hills but live in another city—or even another state—you’re not alone. In fact, many heirs find themselves managing a property from hundreds or thousands of miles away. While the idea of selling the inherited home through a traditional process might seem appealing at first, the logistics quickly become overwhelming when mold or water damage is involved.

Here’s why many out-of-state heirs opt for a fast cash sale instead:

1. Travel and Time Constraints

Flying back and forth to inspect the property, meet with contractors, or sign paperwork can become time-consuming and expensive. Add in the time it takes to manage remediation, showings, negotiations, and closing, and you’re looking at weeks—or months—of long-distance stress.

By contrast, local cash home buyers like Simple Homebuyers can handle the entire transaction remotely. In most cases, you won’t need to return to Temple Hills at all. We handle everything from the walkthrough to the closing and can even mail your payment or wire it directly to your bank account.

2. Higher Risk of Unchecked Damage

Mold and water damage worsen over time. If no one is regularly inspecting the property, what starts as a small leak can evolve into structural rot or hazardous mold growth. An out-of-state owner might not even know the extent of the damage until it’s too late—and by then, remediation costs could be through the roof.

Selling as-is avoids the risk of watching your inheritance lose value every day it sits vacant.

3. Ease of Probate and Title Transfer

When you’re dealing with probate in Maryland and live outside the state, the paperwork alone can be a nightmare. Local investors who specialize in inherited properties often have legal teams that assist with probate filings, title clearing, and necessary court documents.

That level of support can make a complicated process feel much more manageable.

4. Avoiding Holding Costs

Every month you hold the property, you’re paying taxes, insurance, utilities, and possibly HOA fees. These costs add up—especially if you’re still paying your own rent or mortgage in your home state.

Rather than lose thousands maintaining a vacant property you don’t intend to keep, many heirs choose to sell quickly and pocket the proceeds.

How Mold Affects Buyer Perception in the Temple Hills Market

When it comes to selling any home, perception is everything—and mold is one of the fastest ways to sour buyer interest. In Temple Hills, where many buyers are seeking turnkey homes or investment-ready properties, the presence of mold can shift a property’s appeal from “opportunity” to “liability” in seconds.

1. Fear of Health Hazards

Buyers are increasingly concerned about indoor air quality and the long-term health risks of mold. Even if the mold has been remediated, a documented history of mold can deter families, especially those with young children, elderly members, or individuals with asthma. According to the Environmental Protection Agency (EPA), exposure to mold can cause allergic reactions, skin irritation, and respiratory problems, making it a red flag during buyer walkthroughs or inspections.

2. Financing Challenges

Many traditional mortgage lenders will not approve loans on properties with known mold issues. This drastically reduces your pool of potential buyers to either investors or cash buyers. Even if the buyer is interested, their lender might demand full remediation and re-inspection before releasing funds.

In a market like Temple Hills, where demand is strong but price sensitivity is high, financing hurdles can derail deals—causing delays or even cancellations.

3. Stigma and Price Reduction

Even after remediation, the “mold stigma” lingers. Buyers may assume that if the home had mold once, it could happen again. This can lead to aggressive negotiation tactics, steep price reductions, or conditional offers that include inspection contingencies and escrow holds.

If you’re not prepared to counter those objections with documentation, warranties, and expert reports, you may find yourself losing thousands—or struggling to sell at all.

4. Investor Leverage

Investors are aware of the challenges that mold presents. While some will use this knowledge to lowball sellers, others—like Simple Homebuyers—work with integrity to make fair offers that reflect actual repair costs and current market value. The difference lies in experience and reputation. Selling to a trusted cash buyer can help you bypass the fear-based negotiations and get a clean deal closed fast.

This buyer psychology underscores why selling as-is can be a more appealing option than trying to fight uphill for traditional buyer approval. When perception is reality, cash buyers provide certainty.

Pros and Cons of Selling As-Is vs. Renovating an Inherited Home in Temple Hills

When inheriting a property in Temple Hills that has mold or water damage, one of the first decisions you’ll face is whether to renovate the home for top market value or sell it “as-is.” Both strategies come with pros and cons—but only one makes sense if you’re dealing with extensive damage, limited time, or financial constraints.

Selling As-Is: Fast and Simple, but at a Discount

Pros:

- Quick sale: Selling a house as-is—especially to a cash home buyer like Simple Homebuyers—can result in a sale within days or weeks, not months.

- No upfront investment: You don’t need to pay for repairs, staging, inspections, or agent commissions. This is crucial if you’ve inherited the home and are already dealing with probate costs, taxes, or legal fees.

- Ideal for out-of-state heirs: Many inheritors don’t live in Temple Hills and can’t manage contractors or supervise renovations. Selling as-is removes the logistical burden.

- Fewer contingencies: Cash buyers typically waive appraisal and financing contingencies, making the sale less likely to fall through.

Cons:

- Lower sale price: Cash offers for as-is homes are typically below market value, as the buyer is taking on the cost and risk of repairs.

- Emotional difficulty: Letting go of a family home without restoring it may feel like a loss for some sellers, especially if there’s sentimental value.

Renovating Before Selling: Higher Price, But Higher Risk

Pros:

- Maximize resale value: A fully repaired and remodeled home can sell for top dollar—if you have the time and funds to do it right.

- Attract traditional buyers: With mold remediated and water damage repaired, you open the door to a larger buyer pool, including those using financing.

Cons:

- High upfront costs: According to HomeGuide, the average cost to renovate a home ranges from $15,000 to $75,000 or more, depending on the scope. Mold remediation alone can cost $2,000–$10,000+.

- Time-consuming: Coordinating contractors, waiting for permits, and managing inspections can take 3–6 months, delaying your ability to liquidate the asset.

- No guarantee of ROI: The Temple Hills market is competitive, and buyers may still underbid—especially if your renovations don’t meet their expectations.

Which Is Better for Temple Hills Inheritors?

If you’re dealing with serious mold or water issues, or you don’t have the financial and emotional bandwidth to take on a renovation project, selling as-is is often the most practical—and profitable—choice.

Cash buyers specialize in buying homes with mold damage in Temple Hills and nearby areas, offering a no-hassle process with fair market-based offers. You won’t have to clean, repair, or disclose more than you legally have to—they’ll handle it all.

What Buyers and Investors Look For in Mold-Damaged Inherited Homes

Understanding what potential buyers and investors are looking for in mold-damaged homes can make all the difference when selling your inherited property in Temple Hills. While traditional homebuyers may be turned off by even small signs of water damage, investors approach these homes differently. Their goal isn’t just to find a move-in-ready property—it’s to find opportunity.

Most investors seek properties with mold or water issues because they can purchase them at a discount, make the necessary repairs, and resell or rent them at a profit. But they still follow specific criteria before making an offer. Here’s what serious buyers will evaluate:

- Extent of mold and water damage: Investors will typically inspect the HVAC system, basement, crawl spaces, ceilings, and walls to assess the spread of mold and moisture.

- Structural integrity: If the mold has compromised the framing or foundation, the cost of repair may exceed the property’s resale value.

- Location and neighborhood trends: A moldy house in a high-demand neighborhood in Temple Hills might still fetch a solid offer, especially if the bones are good.

- Remediation history: Investors prefer homes where mold hasn’t been previously treated poorly. Improper cleanup can cause future liability.

- Legal disclosures: Buyers want assurance that the property meets Maryland’s required mold disclosure laws, especially for inherited properties.

By understanding what matters most to these buyers, you can make the selling process more efficient. Instead of spending thousands trying to restore the home yourself, focus on presenting it honestly and working with cash buyers who already understand the risks and potential.

For a deeper understanding of how mold-damaged homes are bought and sold across Maryland, visit our comprehensive pillar page on how to sell a house in Maryland with mold.

Making the Smartest Exit From a Mold-Damaged Inherited Property

Inheriting a home in Temple Hills is often filled with mixed emotions—but when that home comes with mold or water damage, it quickly shifts from sentimental to stressful. From navigating Maryland’s strict disclosure laws to assessing whether to remediate or sell as-is, you’re faced with decisions that can impact your financial health, legal liability, and peace of mind.

While traditional real estate sales may work for pristine, updated homes, properties with mold or water damage typically don’t attract conventional buyers. You might find yourself sinking thousands into repairs, juggling contractor schedules, and waiting months just to hope for a fair offer. For many heirs—especially those out of state or managing probate—this route simply isn’t realistic.

Selling to a reputable local cash buyer like Simple Homebuyers allows you to avoid the uncertainty. You’ll receive a fair, fast, and legally compliant offer without needing to clean up, fix up, or stress over inspections. We understand what buyers and investors look for in Temple Hills, and we’re here to take the burden off your shoulders.

Whether your inherited house is covered in mold, has extensive water damage, or is simply too overwhelming to handle, there is a path forward—and you don’t have to take it alone. Explore your options, prioritize your well-being, and make the decision that protects your legacy, your finances, and your time.