Deciding whether to make repairs to your Maryland house before selling in hopes of boosting your final sales price, or keeping your money in your pocket and selling it as-is, can be a difficult choice for homeowners. However, several important factors play a role in the decision. Keep reading as we break down whether making repairs to your Maryland house before selling is the right move.

Circumstances

For many Maryland homeowners, deciding whether to make repairs before selling often comes down to finances and personal circumstances. Sellers must bear the out-of-pocket costs of making repairs to your Maryland house before selling it, with the hope that these updates will generate a higher final sales price. The challenge is that it takes money to make money. If a seller doesn’t have access to available funds or financing, major repairs may simply not be an option. Even if the funds are available, there’s no guarantee that every dollar spent will come back as profit.

Living in the property during repairs is another significant factor. Renovations can be disruptive, messy, and stressful, especially if they take weeks or even months to complete. Dust, noise, and contractors coming and going daily can quickly wear down even the most patient homeowner. For families with children, seniors, or anyone working from home, this disruption can feel overwhelming and exhausting.

This is where professional buyers such as those at Simple Homebuyers offer an alternative. We purchase homes in Maryland as-is, meaning you don’t have to invest a dime into repairs or worry about making the property “market ready.” Instead, you can move forward with a straightforward cash sale, skip inspections, and leave the headaches behind. Professional buyers with cash-backed resources can close quickly, removing the uncertainty and delays that come with traditional sales.

By choosing a direct sale to Simple Homebuyers, you eliminate the worry of whether your property will pass inspection or if repair projects will go over budget. You also gain the peace of mind that comes with selling on your terms, without the stress of ongoing construction in your home.

Increased Profits

One of the biggest questions Maryland homeowners face is whether making repairs will significantly increase their profits. Buyers in today’s market generally prefer move-in ready homes, so investing in repairs before selling your Maryland house can make your property more attractive. A fresh coat of paint, updated kitchen, or modernized bathrooms can certainly improve appeal. However, the critical question is whether the after-repair value (ARV) will outweigh the cost, time, and effort of the renovations.

Determining ARV requires professional estimates. Sellers should reach out to multiple contractors and service providers to get accurate bids for the work, but this process alone can take weeks. Even with the most competitive pricing, some repairs may not provide a return on investment. For example, replacing a roof might be necessary for the sale, but it rarely adds enough value to increase profits significantly. Location, neighborhood demand, and current market trends all factor heavily into whether repairs are worth it.

Professional buyers at Simple Homebuyers simplify this process by offering side-by-side comparisons. Our full-service in-house team of industry specialists can quickly provide accurate numbers to show you how much you might expect to profit from listing after repairs compared to a direct as-is offer. This transparency allows you to make an informed decision.

At Simple Homebuyers, our goal is not just to buy houses but to help Maryland sellers feel confident in their choices. That’s why we make fair offers that reflect both the value of the property and the convenience of skipping the repair process. For many sellers, the ability to avoid contractor delays, inspection surprises, and additional holding costs ends up being more valuable than chasing a slightly higher sale price.

Time

In real estate, time is money, and this couldn’t be more true for homeowners deciding whether to make repairs before selling. When you choose to repair your Maryland house before selling, you must factor in not just the cost of materials and labor, but also the cost of time. Every additional week or month that repairs take is another week of paying a mortgage, utilities, property taxes, and insurance. These holding costs can quickly add up, eating into potential profits.

Delays are also common with contractors. Projects often take longer than expected, especially if materials are back-ordered or workers are juggling multiple jobs. Even once repairs are complete, listing your house on the traditional market doesn’t guarantee a quick sale. Depending on the property, it could take weeks or months to find the right buyer.

Professional buyers at Simple Homebuyers offer an alternative for homeowners who don’t have time on their side. We can provide you with a reliable timeline for repairs if you’re considering that route, but we can also give you a guaranteed cash offer and closing date. In many cases, sellers are able to close within days, which is ideal for those facing relocation, foreclosure, divorce, or financial hardship.

For sellers who need flexibility, Simple Homebuyers can also adjust the closing date to align with your personal timeline. If you need a bit more time to pack, arrange movers, or find your next home, we can work with you. This flexibility ensures you don’t feel rushed but still avoids the drawn-out uncertainty of traditional sales.

Stress and Convenience

Beyond finances and profit, convenience plays a major role in whether to repair a house before selling. Making repairs means coordinating with contractors, overseeing work, managing delays, and dealing with the constant stress of whether the improvements will meet buyer expectations. For many Maryland sellers, this process feels overwhelming, especially when layered on top of already stressful life events like job relocation, divorce, or probate.

By selling directly to Simple Homebuyers, you eliminate this stress. Our team handles all aspects of the transaction, so you don’t have to juggle contractors or worry about last-minute repair demands from a buyer. You sell your Maryland house as-is, leave behind what you don’t want, and walk away with cash in hand. Convenience and peace of mind often outweigh the potential financial upside of making repairs.

Risk of Repairs Not Paying Off

Another often-overlooked factor is the risk that repairs simply won’t pay off. Home improvement projects don’t always translate into higher profits, especially if market conditions shift. For example, a Maryland homeowner might invest $20,000 in updates expecting to increase their property value by $30,000. But if interest rates rise or buyer demand falls, the house may still sell for less than expected, leaving the seller at a loss.

This risk is especially high with large-scale renovations. Structural issues, hidden damage, or unexpected repair complications can quickly push costs beyond initial estimates. By selling your Maryland house as-is to Simple Homebuyers, you transfer this risk to us. We assume the burden of making repairs and take on the market risk, while you walk away with a guaranteed sale and no surprises.

Market Conditions in Maryland

Finally, the current real estate market in Maryland heavily influences whether making repairs makes sense. In a strong seller’s market, homes often sell quickly even if they need cosmetic updates. Buyers are more willing to overlook repairs when inventory is low. On the other hand, in a buyer’s market, competition is fierce, and homes in pristine condition tend to sell faster and for more money.

Professional buyers like Simple Homebuyers stay on top of Maryland market trends, which means we can give you honest advice about whether repairs will truly add value in your situation. By working with us, you won’t have to gamble on market shifts—you’ll get a clear, guaranteed path forward.

Hidden Costs of Delaying the Sale

One factor many Maryland homeowners overlook when considering repairs before selling is the hidden cost of delay. Every month you hold onto the property, you continue to pay the mortgage, utilities, property taxes, insurance, HOA fees, and maintenance. These ongoing expenses can quickly add up to thousands of dollars, eating away at any additional profit you might hope to make by repairing your Maryland house before selling it.

For example, if your mortgage payment is $2,000 per month, property taxes are $300, and utilities average $200, that’s $2,500 in monthly holding costs. If repairs take three months and it takes another three months to find a buyer and close, you’ve spent $15,000 in holding costs—before even factoring in repair bills. For many homeowners, this expense outweighs any potential increase in the sales price.

Professional buyers like Simple Homebuyers help you avoid these hidden costs by providing a fast, guaranteed closing. With our cash offers, you can sell your Maryland house as-is without waiting months to finish repairs or deal with a lengthy listing process. This means more money in your pocket and less risk of draining your savings while you wait for the perfect buyer.

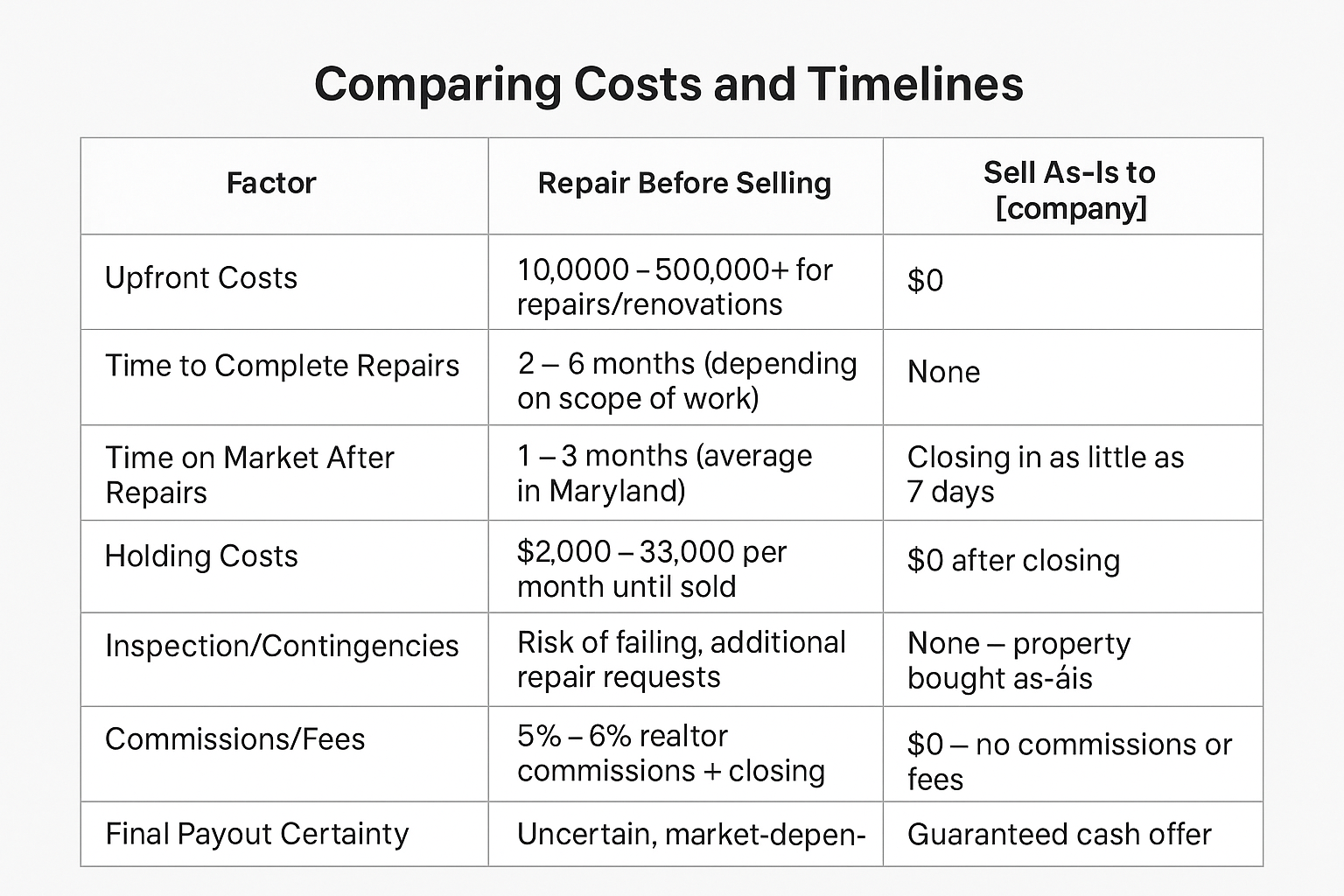

Chart: Comparing Costs and Timelines

Here’s a simple breakdown showing the difference between repairing before selling vs. selling as-is to a professional buyer like Simple Homebuyers.

| Factor | Repair Before Selling | Sell As-Is to Simple Homebuyers |

|---|---|---|

| Upfront Costs | $10,000 – $50,000+ for repairs/renovations | $0 |

| Time to Complete Repairs | 2 – 6 months (depending on scope of work) | None |

| Time on Market After Repairs | 1 – 3 months (average in Maryland) | Closing in as little as 7 days |

| Holding Costs | $2,000 – $3,000 per month until sold | $0 after closing |

| Inspection/Contingencies | Risk of failing, additional repair requests | None – property bought as-is |

| Commissions/Fees | 5% – 6% realtor commissions + closing costs | $0 – no commissions or fees |

| Final Payout Certainty | Uncertain, market-dependent | Guaranteed cash offer |

Conclusion

Why not talk to the professional buyers at Simple Homebuyers about whether you should make repairs to your Maryland house before selling, with absolutely no obligation? At Simple Homebuyers, we put sellers first. We take the time to answer your questions, address your concerns, and walk you through every option. Best of all, we never charge commissions, there are no hidden fees, and we even cover closing costs.

Our offers reflect exactly what you’ll walk away with after the sale, so you’ll know upfront what to expect. Whether you choose to repair or sell as-is, our goal is to help you make the best decision for your unique circumstances. Call Simple Homebuyers at (240) 776-2887 today and discover the difference working with a trusted professional buyer can make.